It calculates losses and gains on stocks, bonds, mutual funds, and employee stock plans.

#Turbotax which version do i need plus

Beginning in 2022, if you receive over 600 in an online payment app, the platform will send Form 1099-K to you and the IRS. Turbotax recommends the Premier Edition, which has all the features of Deluxe plus more tools to deal with investments and rental property, to people who have stocks and bonds or rental income. You need to report all business income received in these apps.

#Turbotax which version do i need for free

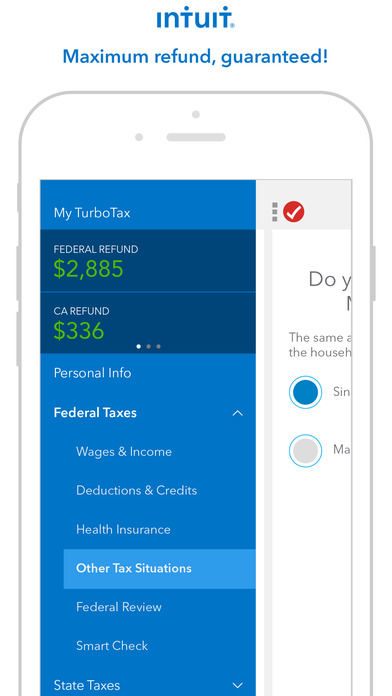

If you’re 25 and under, did you know you can file your tax return for free with TurboTax?ĭo your taxes by yourself, have an expert answer questions along the way and review your return before you file, or hand them off to an expert who will handle them for you from start-to-finish. The new rules create tax implications when using peer-to-peer payment apps such as PayPal and Venmo to make mobile money transfers. Investors with income from stocks, bonds, cryptocurrency, rental property, capital gains and losses, and foreign incomeĬanadians with both personal and business income & expenses, including small business, side gigs, and anything in between Maximizing credits and deductions with slightly more complex tax situations, such as medical expenses and donations Simple returns, including employment income, RRSPs, dependents, student credits and COVID-19 benefits There are four versions of TurboTax tailored to your needs: We match you with the best TurboTax option based on your life, needs, and preference on how much help you want while filing your taxes. TurboTax Premium meets the needs of investors, rental property owners, freelancers, gig workers, and the self-employed. If your profit exceeds the 250,000 or 500,000 limit, the excess is typically reported as a capital gain on Schedule D. While an LLC does not pay taxes directly from the business during tax season, the owners must file an information corporate return on Form 1065, which is a. It has all of the same features and benefits of TurboTax Premier and TurboTax Self-Employed, which are no longer available. Key Takeaways If you owned and lived in the home for a total of two of the five years before the sale, then up to 250,000 of profit is tax-free (or up to 500,000 if you are married and file a joint return). Or go to Deductions & Credits, and select Start next to Foreign Tax Credit under Estimates and Other Taxes Paid. Select Search, enter foreign tax credit and select Jump to foreign tax credit. Enter all your foreign income in Wages & Income if you havent already. No matter your tax situation, we’ve got you covered. Yes, TurboTax Premium is a new product for TurboTax Online customers. Heres what you do: Open (continue) your return in TurboTax. TurboTax offers four product tiers - Basic, Deluxe, Premier and Self-Employed - depending on the complexity of your return and how much live help you want. How do I know which TurboTax product is right for me?

0 kommentar(er)

0 kommentar(er)